CREDIT SCORE IS IN NEEDED WHEN YOU ARE BUYING HOUSE

Lenders look at a number of factors when granting credit, particularly your affordability. They need to ensure you have sufficient income after expenses to repay the loan or financing. The credit score is, however, extremely important to them as it illustrates your past credit behavior and determines the risk of the loan.

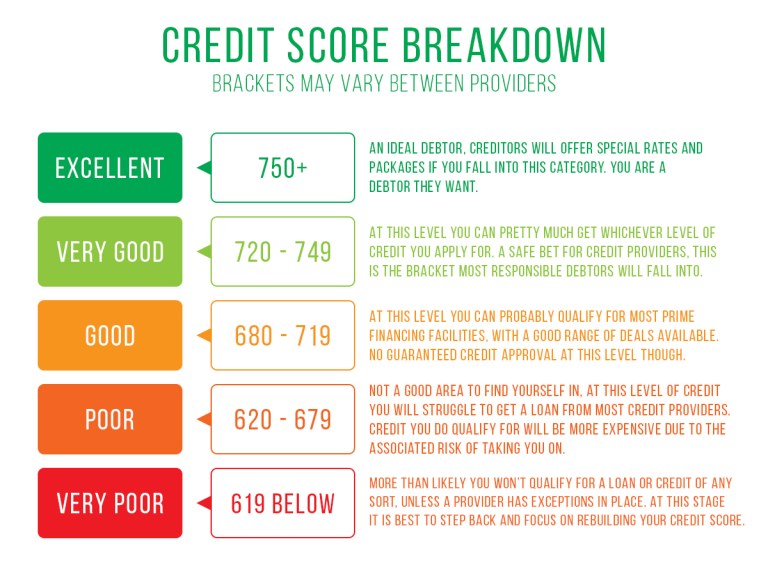

Credit scores range from 300 to 850 with the higher scores being more positive. A score in excess of 700 is a good score and should give you good access to credit at a preferential interest rate. Above 767 is excellent and shows you to be a very low-risk consumer that institutions would be happy to give credit to.

Scores below 581 are considered to be below average and a higher risk to financial institutions. Below 526 is seen as unfavorable and you will have difficulty getting finance with a score in that range. If you did manage to get credit the interest will be extremely high.

WHAT IS YOUR CREDIT SCORE?